Compare Gold Bar Prices

We compare gold bars at low premiums above spot from approved refiners.

Gold bars are a very safe way to invest in gold and even during times of crisis they tend to increase in value. Bars come in a wide range of sizes with many investors buying large bars to bolster their portfolio whilst others enjoy the smaller sizes as they can sell in batches.

Compare Gold Bar Prices

Why Choose Gold Bars for Investment?

Gold bars can often provide lower premiums per gram, particularly in larger sizes, making them a cost-effective way to acquire physical gold. However, certain gold coins such as Sovereigns and Britannias may offer comparable value while also carrying UK Capital Gains Tax exemptions.

Sizes and Flexibility

Gold bars are available in weights ranging from 1g to 1kg and beyond, giving flexibility to both new and experienced investors. Smaller bars are ideal for gradual accumulation, while larger bars can provide better value for bulk purchases.

Tax Benefits of UK Gold Bars

All bullion gold bars are VAT-free in the UK, which adds to their appeal. However, unlike certain British gold coins, gold bars are not exempt from Capital Gains Tax (CGT). Investors seeking CGT-free options should also consider gold coins such as Sovereigns and Britannias.

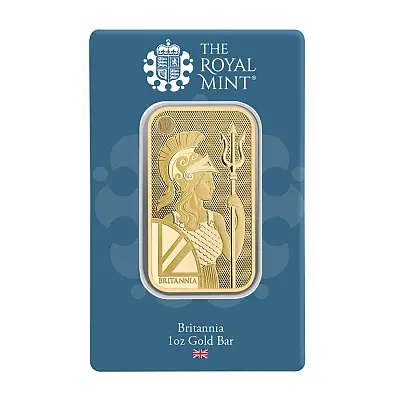

Trusted Refiners and LBMA Approval

Every gold bar compared on our platform is sourced from internationally recognised refiners approved by the London Bullion Market Association (LBMA). This ensures the bars meet strict standards of purity and weight, giving investors confidence in their purchase.

Diversifying with Other Precious Metals

While gold bars remain a key element of precious metal investment, many investors also diversify into silver bars and silver coins for balance and growth potential.